Test update via API

Test update via API

2026 Purchase Order Market Trends

The purchase order automation market is experiencing rapid growth, with AI-powered PO reconciliation projected to reach $4.85 billion by 2029, up from $2.00 billion in 2025 (CAGR: 24.8-25.2%). This growth is driven by:

- Voice-enabled purchasing: 52% of B2B buyers now expect voice support for reorders

- AI automation: Reducing manual errors by 30% and speeding up purchasing cycles by 20%

- Real-time tracking: Modern PO systems provide instant visibility into order status

Frequently Asked Questions About Purchase Orders

What is the minimum order value for a purchase order?

There’s no universal minimum, but most organizations set thresholds between $500-$5,000. Orders below this threshold often use simpler procurement methods like purchase cards or petty cash. The threshold should balance control needs with administrative efficiency.

Do small businesses need purchase orders?

Yes, even small businesses benefit from POs when they have multiple vendors, need spending controls, or want to track commitments. Start with POs for purchases over $1,000 or recurring vendor relationships. As you grow, lower the threshold.

Can you issue a purchase order after receiving goods?

While possible, this defeats the purpose of a PO and creates compliance and audit risks. POs should be issued before ordering to establish a binding agreement, enable proper budgeting, and maintain internal controls. Retroactive POs are generally discouraged.

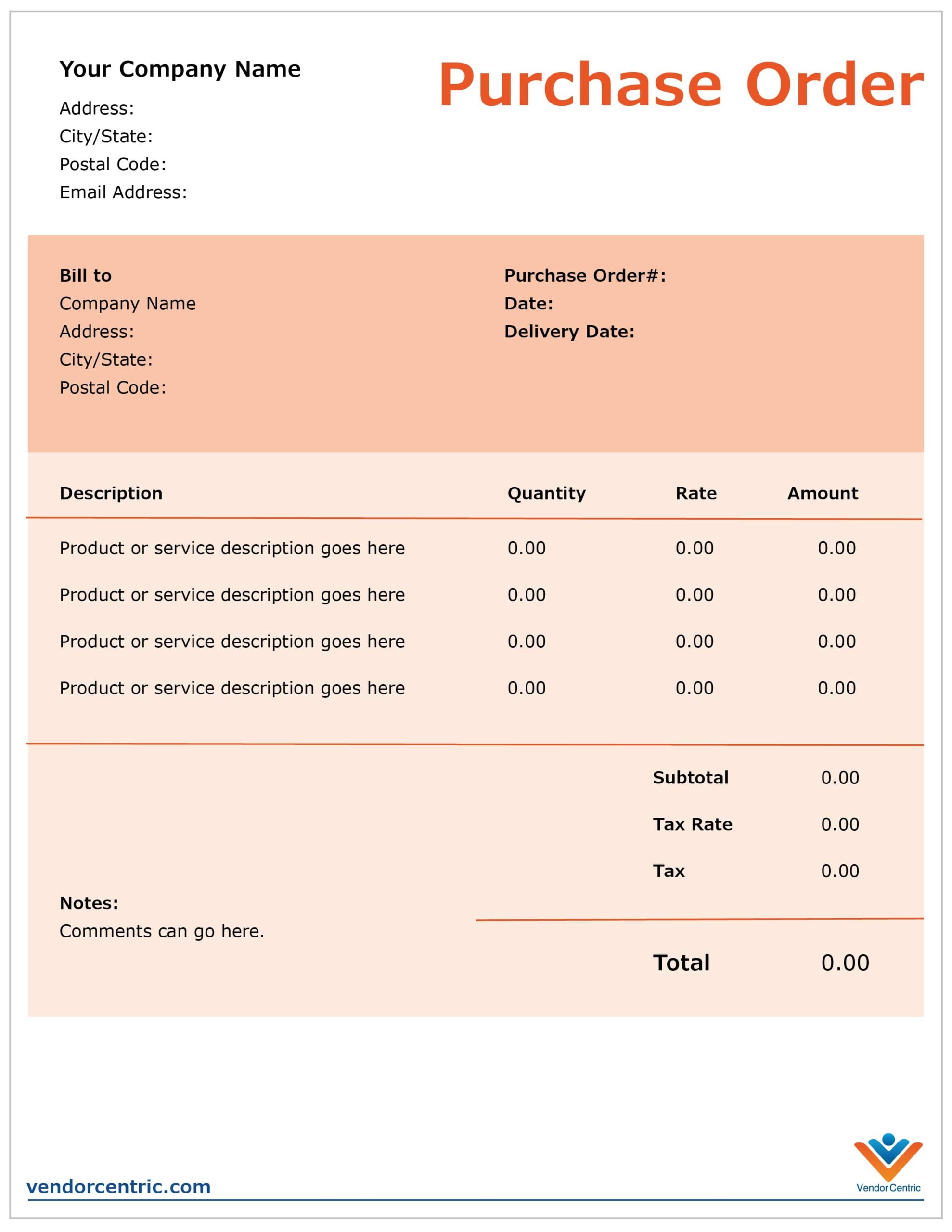

What’s the difference between a PO and an invoice?

A purchase order is issued by the buyer to request goods/services and authorize the purchase. An invoice is issued by the seller to request payment after delivery. The PO comes first, the invoice comes after. Together, they enable three-way matching for payment approval.

2026 Purchase Order Market Trends

The purchase order automation market is experiencing rapid growth, with AI-powered PO reconciliation projected to reach $4.85 billion by 2029, up from $2.00 billion in 2025 (CAGR: 24.8-25.2%). This growth is driven by:

- Voice-enabled purchasing: 52% of B2B buyers now expect voice support for reorders

- AI automation: Reducing manual errors by 30% and speeding up purchasing cycles by 20%

- Real-time tracking: Modern PO systems provide instant visibility into order status

Frequently Asked Questions About Purchase Orders

What is the minimum order value for a purchase order?

There’s no universal minimum, but most organizations set thresholds between $500-$5,000. Orders below this threshold often use simpler procurement methods like purchase cards or petty cash. The threshold should balance control needs with administrative efficiency.

Do small businesses need purchase orders?

Yes, even small businesses benefit from POs when they have multiple vendors, need spending controls, or want to track commitments. Start with POs for purchases over $1,000 or recurring vendor relationships. As you grow, lower the threshold.

Can you issue a purchase order after receiving goods?

While possible, this defeats the purpose of a PO and creates compliance and audit risks. POs should be issued before ordering to establish a binding agreement, enable proper budgeting, and maintain internal controls. Retroactive POs are generally discouraged.

What’s the difference between a PO and an invoice?

A purchase order is issued by the buyer to request goods/services and authorize the purchase. An invoice is issued by the seller to request payment after delivery. The PO comes first, the invoice comes after. Together, they enable three-way matching for payment approval.

Related Resources

Learn more about vendor management best practices:

Last Updated: January 5, 2026

Tom is a trusted advisor on procurement and third-party management to organizations across the United States. Having worked with over 120 organizations over his 30-year career, he has a unique ability to bring creativity and discipline to finding solutions for even the most complex challenges his clients face.

Tom is a trusted advisor on procurement and third-party management to organizations across the United States. Having worked with over 120 organizations over his 30-year career, he has a unique ability to bring creativity and discipline to finding solutions for even the most complex challenges his clients face.