A common question asked by organizations evaluating virtual credit cards is “Why would my vendors want to accept payment through a virtual card?” It’s a great question because there’s a cost to the vendor to accept payment from a virtual card – similar to the cost they pay when processing plastic credit cards.

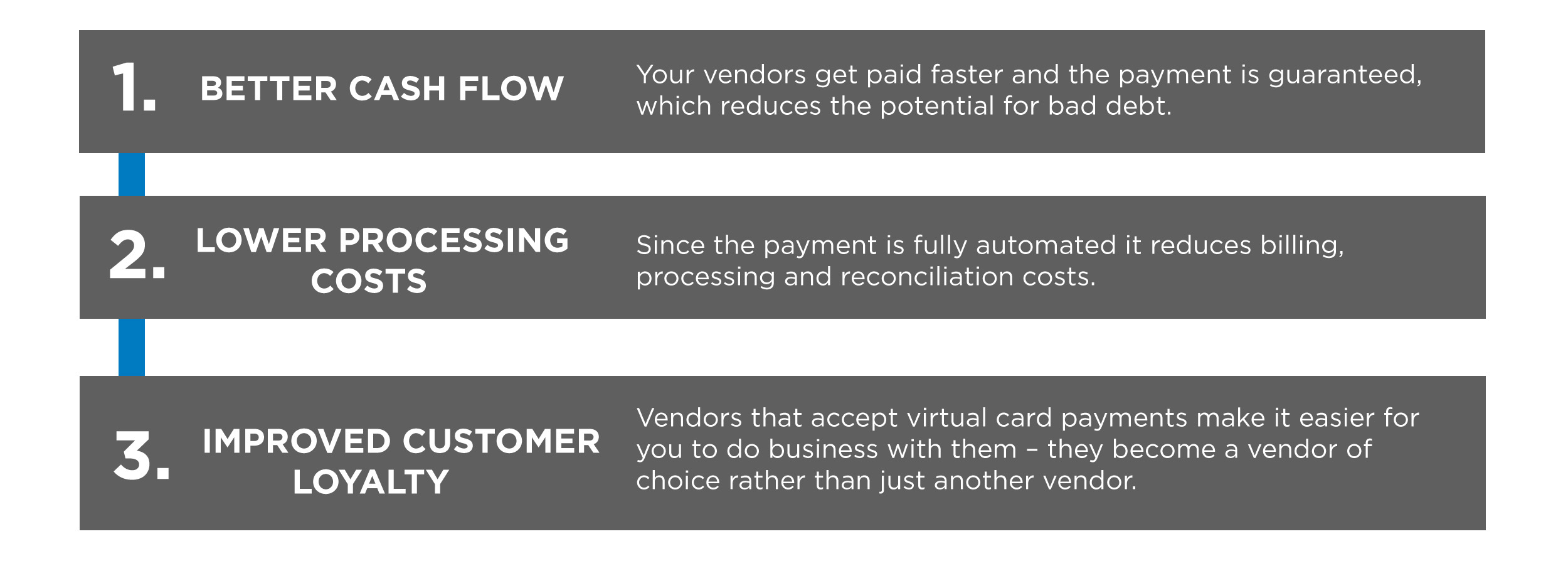

The answer is relatively simple: the benefits of accepting virtual card payments outweigh the costs. Here are the three main benefits driving acceptance by thousands of vendors:

Educating your vendors about these benefits is important because the success of a virtual card program is ultimately driven by how successful you are at enrolling them. And that success is most often driven by the people and processes employed by the company with which you contract for your program – your Virtual Card Processor.

The most successful Virtual Card Processors have a deep team of resources available to support your A/P team during vendor enrollment. They also have a disciplined, data-driven process that they follow. And while the approach may differ among different processors, there are generally three important phases they will follow:

Phase 1 | Develop Your Enrollment Strategy

In order for a vendor to accept payment via a virtual card they must first be enrolled in your program. As such, the primary focus of your vendor enrollment strategy should be to educate your vendors on the benefits of accepting virtual payments. Better cash flow. Lower processing costs. More loyalty from you.

A key part of your enrollment strategy will be to identify those vendors that already accept credit card payments or, even better, payment via a virtual credit card. Your Virtual Card Processor will play an important role in analyzing your master vendor file to create a strategy that targets this group of vendors first and generates enrollment as quickly as possible.

Phase 2 | Facilitate the Enrollment Process

With your enrollment strategy in place you’ll then want to focus on enrolling your vendors. The most successful Virtual Card Processors have extensive vendor enrollment teams and capabilities, and will manage all aspects of the enrollment process for you.

Successful processors also have a database of thousands of vendors that they’ve enrolled previously, which greatly increases the chances those vendors will enroll with you as well. Both of these are critical to not only reducing the time needed from your accounts payable team, but to also ensure you maximize the potential for enrollment in your program.

Phase 3 | Set Up Your Enrolled Vendors

Once your vendors are enrolled the final phase is to onboard them and begin processing their payments. It is a straight-forward process that requires identifying enrolled vendors in your accounts payable system, and coordinating with your Virtual Card Processor to establish protocols for electronic file submissions. Once vendors have been set up, you can begin immediately paying them electronically.

Learn more about one of the fastest growing forms of electronic payment in our free publication, The Nonprofit CFO’s Guide to Virtual Credit Cards. Download now.

Tom is a trusted advisor on procurement and third-party management to organizations across the United States. Having worked with over 120 organizations over his 30-year career, he has a unique ability to bring creativity and discipline to finding solutions for even the most complex challenges his clients face.

Tom is a trusted advisor on procurement and third-party management to organizations across the United States. Having worked with over 120 organizations over his 30-year career, he has a unique ability to bring creativity and discipline to finding solutions for even the most complex challenges his clients face.